My Financial Plan

Payment Options

1. Payment Plan

This is an interest-free option that divides your remaining balance into equal monthly payments. This makes paying your remaining expenses manageable.

You set up a monthly plan through Transact, a third-party authorized vendor. There is a $50 fee per semester. This is not a loan and there are no interest fees. The first payment will be due upon enrollment in the tuition payment plan. Billing statements are posted on myCIA.

For questions or help with set-up, contact the Office of Student Accounts at 216.421.7318 or at studentaccounts@cia.edu.

Walk through the steps with visuals below.

2. Out-of-Pocket Payments

With an out-of-pocket payment, your remaining balance is due by July 15 for the Fall semester and December 15 for the Spring semester. CIA accepts cash, checks, wire transfers, credit card payments, debit card payments, ACH payments made directly from a bank account, and payments made using a 529 college savings account.

3. Parent PLUS Loan

This option is for parents of dependent undergraduate students. Parents can borrow a PLUS loan up to the cost of attendance minus other financial aid their student receives.

Both you and your parent(s) need to meet eligibility requirements, including U.S. citizenship. Federal/Direct PLUS have a fixed interest rate of 9.08% and it has a 4.228% fee.

4. Private/Alternative Education Loans

Private (alternative) education loans are offered by banks and private lenders to the student. Some lenders have parent or sponsor loans as well. Since these are credit based, a credit-worthy co-borrower will likely be required on student applications. The interest rate is based upon the credit worthiness of the applicant(s) and most, if not all, loans have no fees. The typical repayment begins six months after graduation or upon leaving school. These loans are not subsidized and the interest accrues from the point of disbursement. The maximum amount that can be borrowed in an academic year is the total cost of attendance minus all other aid offered.

For a private education loan, you or your parent will need to choose a lender (CIA doesn't endorse any specific lender). More info is available on the FastChoice website.

Financial Aid Disbursement

Net Partner is a financial aid portal where you will review your financial aid, accept or decline your federal student loans and see if any documents need to be completed. Once you accept your financial aid in Net Partner, and all of your required documents are received, your aid will post to your student account.

During the third week of each semester, as long as your financial aid documents and class registration are complete, your financial aid will be disbursed and posted on your student account statement.

After ALL financial aid has been disbursed and posted, if your financial aid covers more than your school balance on your statement, a credit balance will be generated. The Student Accounts office will issue a refund as a result of this credit balance no later than 14 days after the credit balance occurred.

Enrolled students will need to complete a direct deposit form to have their refund sent electronically to their bank account. The form can be found on myCIA within the My Students area (login required).

Bill Payment

Fall billing statements are made available for returning students on myCIA mid-May, and mid-June for new students. Billing statements for spring semester are available mid-November.

Contact the Office of Student Accounts at 216.421.7318 or studentaccounts@cia.edu if you have any questions about your billing statement or making payments.

Making a Payment/Payment Plan

Through our third-party partner, Transact, you can make a payment toward your tuition balance from your bank account, 529 account, or credit card (2.85% transaction fee for credit card use).

You can also set-up a 6-month, 5-month, or 4-month interest-free payment plan each semester.

Step-by-step instructions

View your balance, make a payment, or set-up a payment plan online with these step-by-step instructions.

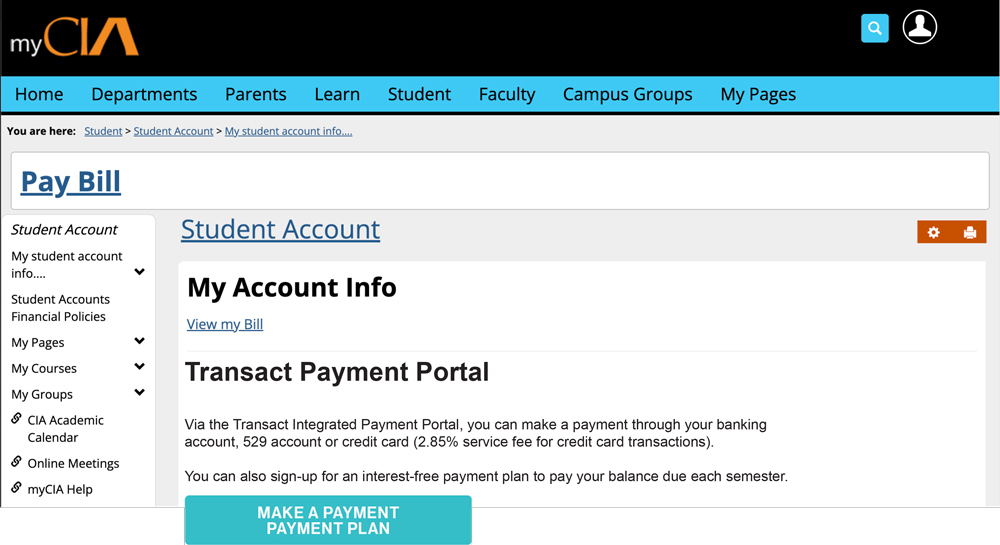

Step 1: Log in

Log in to my.cia.edu/payBill.

Your login will be the student’s first initial, middle initial, and last name (eg. jdsmith). Students set-up their password when they first created their account.

Once you have logged in, you’ll see the screen below.

You can select View my bill, or click on the button to Make a Payment/Payment Plan where you can view your balance and proceed to make a payment or set-up a payment plan.

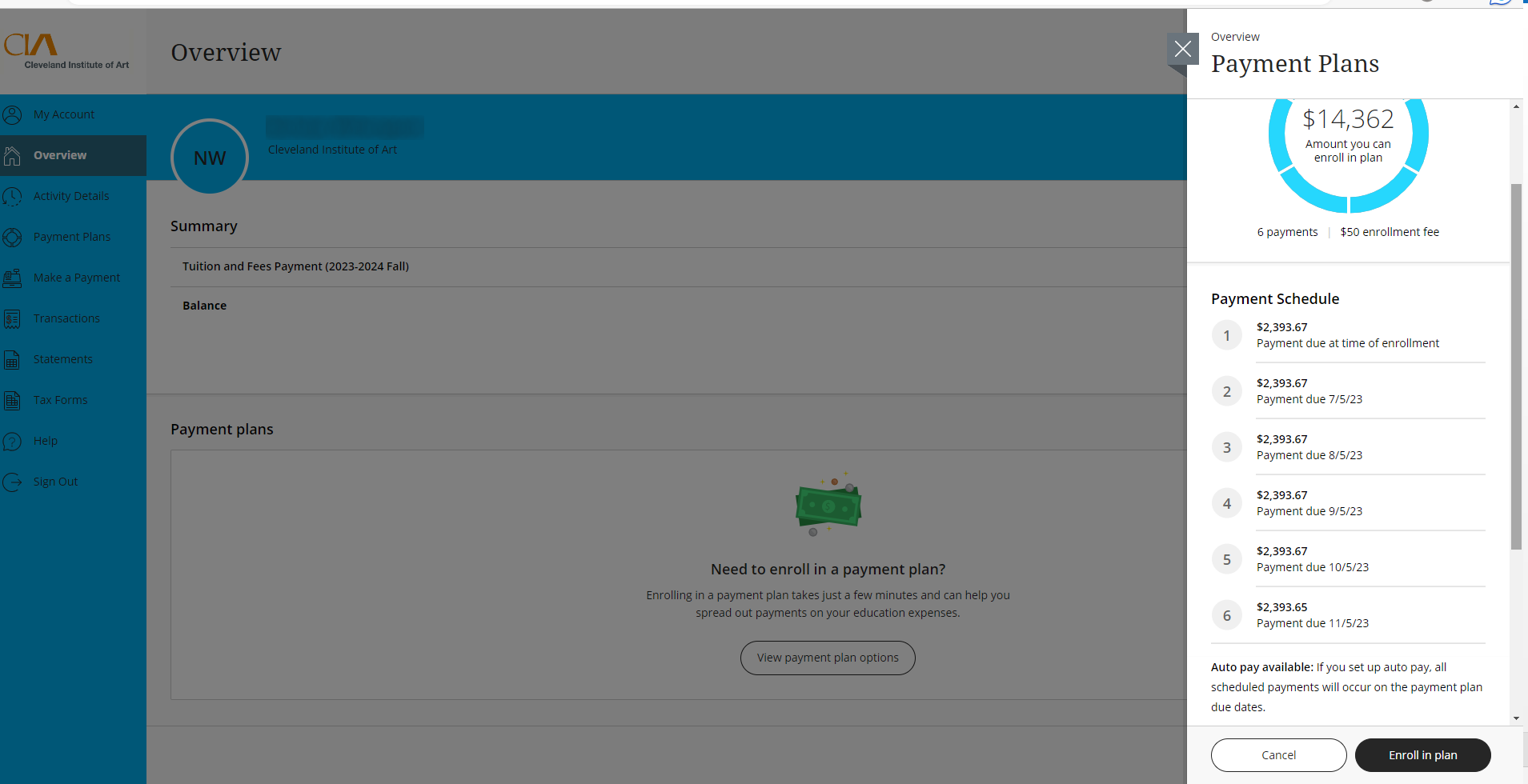

Step 2: View payment plan options

A new tab will open in your browser showing the Transact portal (shown below). Your balance for the semester is shown in the upper right-hand corner (in this example, $14,362).

To set-up a payment plan, click on the white button View payment plan options.

Step 3: Enroll in payment plan

Your semester balance is shown, broken down into the amount and number of payments that are available to you (depending on when you sign-up for payment plan). Click Enroll in plan to continue, where you’ll be prompted to provide banking, 529 plan, credit card, or international payment information.

Step 4: Or make a payment

If you just want to make a payment, click on Make a Payment in the left column. You’ll be taken to the first screen to enter your payment amount, then click Checkout, where you’ll be taken to a second screen to select how you’ll make your payment (banking information, 529 account, international payment, or credit card). Credit card payments will incur at 2.85% transaction fee. There are no fees for payments drawn from your banking account.

If you have any questions, contact our Student Accounts office by email or by calling 216.421.7318.